Introduction

The constantly evolving healthcare landscape has Payers under increasing pressure to deliver more personalized, efficient, and value-driven care. Digital transformation in 2025 is not a lofty aspiration but a clear and urgent priority for Payers facing shifting member expectations, rapid regulatory changes, and mounting competitive pressures. To stay ahead, Payers must move beyond basic compliance and tackle transformative actions that reshape not just their tech stack, but their entire approach to serving members and Providers. By leveraging advanced technologies, Payers are reshaping how care is delivered, managed, and experienced by members.

Regulatory mandates: To fast-track innovation

Recent federal and state mandates are driving Payers to modernize faster than ever. CMS interoperability rules, price transparency requirements, and rising cybersecurity standards are not just regulatory hurdles, but opportunities to unlock new value with real-time data exchange, safe digital experiences, and transparent member communications. Compliance is the baseline, but proactive organizations use these rules to accelerate innovation and member-centric care.

Payers must get ready for the next wave of rules governing the use of AI in clinical decision-making and administrative processes. Standards like FHIR for data exchange, evolving mandates on prior authorization, and emerging human-in-the-loop oversight requirements mean that Payers will need to double down on explainability, transparency, and ethical AI deployment.

Modernizing infrastructure for scalable growth

Digital transformation begins with the modernization of core infrastructure. Leading Payers are transitioning from legacy systems to cloud-native platforms and implementing scalable, interoperable data architectures. These upgrades provide real-time data access, faster processing, and smooth integration with other systems, creating a strong foundation for ongoing innovation and flexibility.

Migrating from legacy systems to scalable, interoperable cloud platforms unlocks the ability to respond quickly to change, onboard new tools, and manage data securely at scale. Investments in infrastructure lay the groundwork for every downstream innovation, whether business intelligence, analytics, or member engagement.

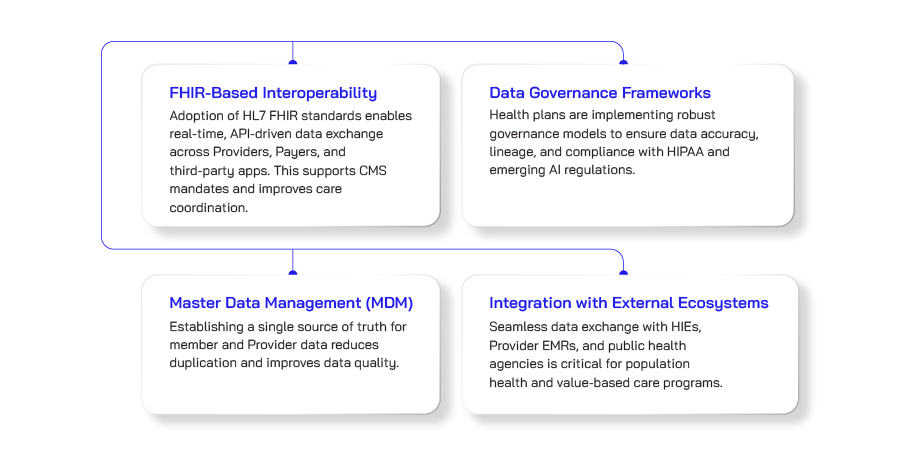

Data integration and interoperability

In the evolving landscape of healthcare digital transformation, data integration and interoperability are no longer optional; they are strategic imperatives. Payers are increasingly anchoring their digital initiatives in robust data strategies aimed at constructing a unified, longitudinal view of each member. This requires seamless integration across diverse data domains including clinical, claims, pharmacy, behavioral health, and social determinants of health (SDoH).

Key components

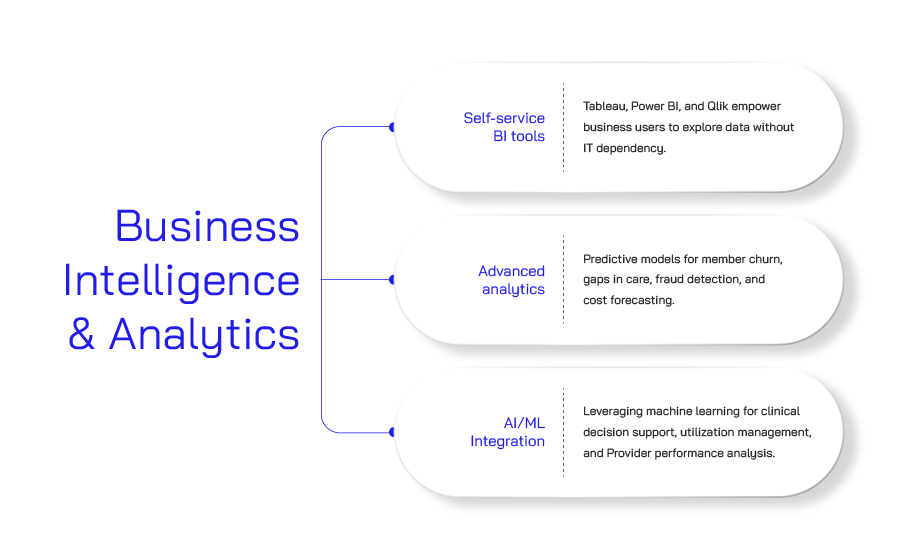

Cloud-based data strategy with Business Intelligence and Analytics

By adopting a robust data-on-cloud strategy, Payers are driving data democratization across departments, enabling business users, clinicians, and operations teams to access actionable insights without IT bottlenecks. Real-time dashboards powered by cloud-native analytics platforms provide visibility into operational KPIs, Stars and HEDIS performance, and financial metrics, allowing for agile decision-making and continuous improvement. These capabilities also support strategic planning, network optimization, and member retention initiatives by surfacing trends, identifying gaps in care, and enabling targeted interventions that align with value-based care goals.

Driving efficiency with AI and automation

Artificial Intelligence (AI) and automation are transforming back-office operations and clinical workflows. Predictive analytics help identify high-risk members and anticipate care needs. Robotic Process Automation (RPA) streamlines claims processing, billing, and member communications. These technologies reduce administrative burden, improve accuracy, and free up resources for strategic initiatives.

Digital transformation also addresses workforce challenges. Automation reduces repetitive tasks, while decision support tools enhance clinical accuracy. Remote work capabilities and virtual collaboration platforms improve flexibility and staff satisfaction. These innovations help health plans retain talent and maintain high-quality service delivery.

Rethinking member engagement

Digital transformation is not just about upgrading systems, it is about making life easier for members. Payers are introducing mobile apps, telehealth services, and AI chatbots so members can access care anytime, track their health, and get medication reminders. These tools simplify healthcare, make it more personal, and keep members engaged, leading to better outcomes and greater satisfaction.

Engaging members is the key to better care. That is why Payers are investing in digital solutions that offer 24/7 access to information and support. Features like wellness tracking, medication alerts, and tailored health content help members stay informed and take control of their health.

Investing in cybersecurity and compliance

With increased digital adoption comes heightened risk. Health plans are strengthening cybersecurity frameworks to protect sensitive data and ensure compliance with regulations like HIPAA. Investments in threat detection, encryption, and staff training are essential to maintaining trust and avoiding costly breaches.

Overcoming the Barriers: Cost, Complexity, Culture

The journey is not without challenges. Digital transformation demands new technologies, ongoing staff training, and top-down commitment. Smaller Payers may struggle to keep pace, but incremental change; the “start small” approach is key. Building early leadership buy-in, developing change management strategies, and partnering with digital transformation experts all help health plans overcome inertia and realize real benefits.

Digital transformation offers immense potential, but Payers face several critical challenges that can hinder progress and impact outcomes:

Cost

Implementing digital transformation initiatives often requires significant financial investment. This includes upgrading legacy systems, procuring new technologies, training staff, and redesigning workflows.

Complexity

Healthcare is a highly regulated and intricate industry. Integrating new technologies into existing systems demands deep domain expertise, careful planning and execution, and coordination across departments.

Culture

Digital transformation is not just about technology, it requires a shift in mindset. Challenges include resistance to change, lack of digital literacy, and siloed organizational structures.

Tips for successful digital transformation

Start small

Implement small, incremental changes that can be easily adopted and scaled, rather than attempting a large-scale transformation all at once.

Gain leadership buy-in

Secure support from leadership, ensuring they understand the vision for digital transformation and are willing to allocate necessary resources.

Partner with experts

Leverage the expertise of companies specializing in digital transformation for healthcare. Collaborating with experienced partners can help overcome challenges and maximize the benefits of digital transformation.

Change management

Digital transformation is as much about people as it is about technology. Effective change management ensures smooth adoption and long-term success. Key strategies include:

- Clear communication: Articulate the vision, benefits, and impact of digital initiatives to all stakeholders.

- Training and Support: Provide hands-on training, resources, and help desks to ease the transition.

- Engagement and feedback: Involve staff early, gather feedback, and adjust plans based on real-world input.

Conclusion: Building a resilient and responsive Payer environment

Digital transformation is redefining the future of health plans. By embracing technology, organizations can enhance care delivery, improve member satisfaction, and achieve operational excellence. The priorities outlined above are not just trends; they are strategic pillars for building a resilient, responsive, and member-centric healthcare ecosystem.

.png?width=1920&height=1080&name=Consulting2_Menu_1%20(1).png)